Step-by-Step Flow: Carbon/ Asset Onboarding, Validation, and Trade

PHASE 1: Asset Onboarding (Supplier-Side)

- Project Registration

- Project developer (e.g., solar farm, DAC facility, reforestation) creates an account.

- Uploads required documentation (project specs, coordinates, tech details).

- Project metadata is hashed and submitted on-chain.

- Asset Typing & Classification

- Auto-tag asset class: carbon credit, EAC (REC, I-REC, etc.), offset/removal.

- Set attributes: vintage year, registry type, tech type (wind, solar, etc.), co-benefits.

- Proof-of-Impact Metadata Generation

- PoI Engine assigns impact domains: emissions, energy, waste, workforce, equity.

- Generates preliminary PoI score and expected contribution per metric ton or unit.

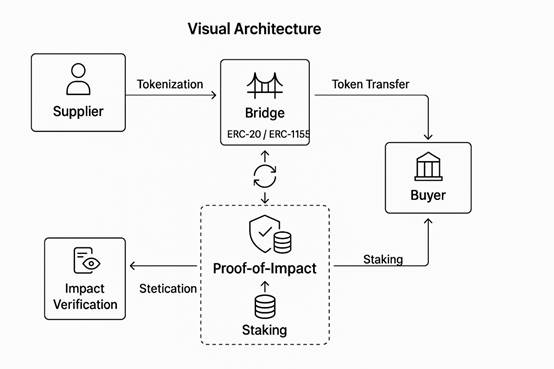

- Smart Contract Tokenization

- Asset batch is wrapped as an ERC-1155 or ERC-721 NFT.

- Metadata includes GPS-tagged proofs, issuance schedule, expiry, retirement conditions.

PHASE 2: Validation & Verification (Validator-Side)

- Validator Assignment

- Validator is matched by geography, tech expertise, and accreditation level.

- DAO quorum or algorithmic match confirms assignment.

- Proof Review & Data Integrity Check

- Validator reviews off-chain documents (permits, satellite, IoT, LCA reports).

- Validator compares on-chain hash with original file.

- On-Site or Remote Audit (if required)

- Optional remote verification via drone, IoT sensor link, or partner platform.

- Field validators may use mobile PoI Validator app to upload media or data.

- Scoring & Signature

- Validator submits updated PoI Score.

- Validator signs off with digital signature + validator ID (stored on-chain).

- DAO or Smart Contract Approval

- Governance layer verifies validator role and outcome.

- PoI score is locked and timestamped.

PHASE 3: Market Activation & Trading

- Asset Listing on Marketplace

- Asset batch appears on the PoI-powered DEX/Marketplace.

- Filtered by PoI score, vintage, tech, geography, impact domains.

- Buy-Side Discovery & Due Diligence

- Corporate buyers or brokers browse verified assets.

- Use filters: Scope 2 alignment, SDG overlap, price/impact efficiency.

- Trade Execution

- Buyer initiates swap: stablecoin (e.g., USDC) for PoI-wrapped asset.

- Smart contract finalizes trade; asset transferred to buyer’s wallet.

- Retirement or Holding

- Buyer can:

- Retire asset (burn token + receive on-chain attestation + PoI claim)

- Hold asset (for future offset, resale, or audit reporting)

- Stake to gain validator or DAO privileges

- Audit & Reporting Layer

- Real-time reporting dashboard.

- Auto-generated ESG reports (GRI, ISSB, CSRD-aligned).

- Exportable attestation with PoI traceability and validator ID.

Insurance or Reversal Buffers (Nature-Based Projects)

Purpose: To protect the integrity of carbon offsets from unintentional reversals (e.g., wildfires, drought, deforestation) and ensure climate permanence.

How It Works:

- For every 100 tons issued, 10–30% is reserved in a “buffer pool.”

- These tokens are non-tradeable and only used in case of reversal.

- Smart contracts auto-adjust total supply if a reversal is confirmed.

On-Chain Enforcement:

- Burnable buffer NFTs or ERC-1155s are tied to the project ID.

- DAO governance or AI risk oracles (fire, drought indices) trigger buffer release.

Example:

A forest project in California loses acreage to wildfire → a validator confirms → the buffer pool auto-burns the affected tons → market confidence is preserved.

IoT-Synced Emissions Monitoring

Purpose: To ensure real-time, tamper-proof data streams are integrated into the PoI score, especially for Scope 1 or Scope 2 emitters (e.g., factories, microgrids).

How It Works:

- Sensors (e.g., NO₂/CO₂ monitors, power meters, satellite APIs) send data to a middleware API.

- Middleware hashes and stores snapshots on-chain (daily or hourly).

- PoI Engine recalculates scores based on live or rolling averages.

Tech Stack:

- MQTT / LoRaWAN devices → JSON → IPFS → Smart Contract Oracle

- Optional: zk-Proofs for data privacy (e.g., in competitive industries)

Example:

A solar microgrid in Kenya reports real-time generation → validator confirms the live feed → credits are issued based on actual usage, not estimated output.

Retroactive PoI Adjustment (Post-Verification Data Updates)

Purpose: To preserve the accuracy and accountability of impact scores even after assets are verified and sold, enabling dynamic PoI scoring.

When Triggered:

- A new audit reveals errors or misreported data.

- IoT or satellite data shows discrepancies.

- Additional community outcomes are achieved (e.g., more jobs created).

How It Works:

- Smart contract versioning tracks all PoI score revisions.

- Buyer wallet receives notification + optional retroactive claim.

- If impact increases, the buyer receives additional PoI tokens or KFG rewards.

- If impact decreases, DAO may claw back or re-score the token’s validity.

Example:

A reforestation project overestimated tree survival → validator update → token’s PoI score is reduced → buyer is notified → dashboard updates impact total for Scope 3 reports.

Pilot DISCOVERY PHASE : Retroactive Asset Onboarding (Past Actions)

Purpose: Recognize and monetize already completed reductions or removals (e.g., past efficiency projects, historic RE generation, prior reforestation vintages) without double-counting.

Eligibility & Evidence

- Define a look-back window (e.g., recent years) and accepted proofs: metered data, utility bills, commissioning/M&V reports, registry attestations, audits.

- Confirm the baseline period and method (ISO 50001-aligned EnPIs where available).

Bulk Data Ingest

- Upload historical datasets (CSV/API): energy/water meters, production normalizers, prior MRV docs.

- Files are hashed; a Retro Batch ID is created on-chain.

Conflict & Double-Count Check

- Automated cross-checks against public/private registries (RECs, offsets) and internal issuance logs.

- One-time “retro” flag applied at the batch level to prevent re-issuance.

Lightweight Validation

- Desk review by matched Validators (sampling approach).

- If needed, targeted spot checks (photos, satellite, limited IoT backfill).

- Validator signs the Retro Statement of Findings; hash stored on-chain.

PoI Scoring & Tokenization

- PoI Engine computes a retro PoI score using the historical data quality and permanence factors.

- Retro batch is tokenized (e.g., ERC-1155), labeled RETRO with vintage years, baseline reference, and retirement rules.

Buffer & Risk Rules (If Applicable)

- Nature-based retro batches apply the standard buffer pool (same rules as live assets).

Listing & Reporting

- Retro assets are listed with a RETRO badge and disclosure of data sources, vintage, and Validator ID.

- Buyer receives an on-chain attestation and auto-ready export for reports.